AUGUST 17, 2020. BY AMY WOLFE, AGSAFE.

As harvest gets underway for some and is in full swing for others, the issue around having sufficient labor persists. The challenge drives many growers to use a farm labor contractor (FLC) as a means for ensuring there are enough people to get the job done. Often, though, growers use FLCs believing that in doing so, there is a firewall of protection between them and the liability of having workers. Nothing could be further from the truth in California. The current COVID-19 pandemic adds layers of complexity to their already complicated relationship, as growers and FLCs alike work diligently to mitigate the disease’s risks. It is critical that growers not only understand the challenges inherent in working with an FLC but also how to vet a contractor to ensure the best possible working relationship.

Understanding Your Joint Employer Risk

Nearly five years ago, California changed the State Labor Code, Section 2810.3 to define joint employment liability more fully as it pertains to worker safety and compensation issues. The modification impacted all employers, not just those in agriculture, and applies when the contracting company (for example, the grower), uses six or more employees from the contractor. If fewer than 20 employees are working between both businesses, there is an exemption from these provisions. However, during harvest when the need for bodies exists, this allowance is rarely any help.

The regulation holds the grower equitably responsible with the FLC for ensuring workers are protected from possible injury and illness, and that all the conditions of employment compensation are met. The latter includes but is not limited to: stipulated wages, a workplace free from harassment and discrimination, and paid sick leave and health insurance is provided. As such, the grower must take steps to ensure that the FLC they work with complies with all these applicable employment laws and that they demonstrate a good faith effort to stay informed of the FLC’s business practices in these areas.

There is also a federal law, updated in March 2020, that speaks to joint employer liability. Under the Fair Labor Standards Act (FLSA), when an employee performs work for the employer that simultaneously benefits another person, that person will be considered a joint employer when that person is acting directly or indirectly in the interest of the employer in relation to the employee.

Part of the update included the creation of a four-part test to simplify for an employer their understanding of whether the liability exists. Joint employment will exist if the grower does the following for the FLC employees:

-

-

-

- hires or fires the employees;

- supervises and controls the employees’ work schedule or conditions of employment to a substantial degree;

- determines the employees’ rate and method of payment; and

- maintains the employees’ employment records.

-

-

The FLSA does not stipulate that all these factors must be in place, nor does it note that the presence of only one of these elements will constitute liability. Rather, the regulation states that all circumstances will be considered, including factors such as the length of the relationship between the grower and FLC, the pervasiveness of the actions by the grower, and the overall workplace culture that exists. The U.S. Department of Labor, Wage and Hour Division enforces the FLSA and, along with the California Department of Industrial Relations, Division of Labor Standards Enforcement will hold a grower liable for the failings of his or her farm labor contractor.

As a result, a grower’s risk has grown because both the U.S. Department of Labor and the California Division of Labor Standards Enforcement can cite the business for the same violation by the farm labor contractor. This is an instance of two-for-the-price-of-one and not in a good way. With so much at stake, it is critical that growers take the time to vet their FLC annually as well as request evidence of compliance throughout the course of the season.

A harvest morning in Lodi. Photo by Randy Caparoso.

Vetting Your Farm Labor Contractor

Prior to when a grower needs the services of an FLC, it is important to request evidence of compliance with the many employment laws impacting the contractor, as well as those that fall under the auspices of joint employment liability. If the contractor is not able to provide written evidence of compliance, that is a sign that the grower may need to consider finding a new farm labor contractor. At a minimum, the FLC should provide the following documentation:

-

-

-

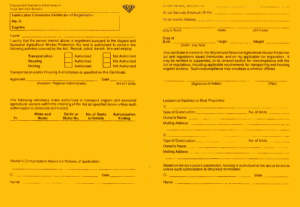

- Copy of current State of California FLC License

- Copy of the Federal FLC Certificate of Registration

- If providing worker transportation, Transportation Authorization should be noted

- If providing worker housing, Housing Authorization should be noted

- Proof of workers’ compensation insurance

- Proof of general liability insurance

- Copy of the Injury and Illness Prevention Program (IIPP)

- Copy of the COVID-19 IIPP Supplement

- Copy of the Heat Illness Prevention Program

- Copy of the Employee Handbook, including an Anti-Harassment and Discrimination Policy

- Evidence of the following annual training for supervisors and workers:

- Sexual Harassment Prevention (2 hours for supervisors, 1 hour for workers)

- General Workplace Safety

- Heat Illness Prevention

- Worker Protection Standard

- COVID-19 Risk Protection

- First Aid/CPR (1 trained individual for every 20 workers)

- Evidence of worker wage and other compensation terms and conditions provided to the crew that will be contracted

- Copy of a paystub, with confidential information removed

-

-

In California, farm labor contractors (FLCs) must possess both a state FLC license as well as a Certificate of Registration, issued by the U.S. Department of Labor, Wage and Hour Division, as seen here.

If, after reviewing these elements and determining compliance, moving forward working with the contractor makes sense, it is also important to check in on the FLC and their crews periodically throughout the season. Onsite, you should be looking for the following, which demonstrates actionable compliance related to the paperwork initially reviewed:

-

-

-

-

- First aid kits with each crew

- Enough water and shade for the number of workers present, including ensuring that workers can maintain appropriate social distancing protocol

- Clean, usable portable toilets with ample hand washing supplies, enough to encourage best practices in accordance with CDC COVID-19 recommendations

- Appropriate personal protective equipment (PPE), including face coverings and hand sanitizer for use when not immediately next to handwashing stations

- An emergency action plan, including a map of how to safely evacuate the property, easily accessible for workers

- Required postings, including Pesticide Safety Information Sheet A-8 and A-9

-

-

-

Should something appear amiss during a field visit, it is critical to communicate what was deficient with the farm labor contractor and determine the immediate corrective action plan. It is also important that follow-up occurs to ensure changes are made and documented. Failing to do so more simply codifies the definitive liability, as defined under California regulations, for the grower based on the lack of compliance by the FLC.

Keep in mind that both the list of items to review prior to engaging a contractor and the list of elements to evaluate in the field are not exhaustive. For a complete, robust list, contact AgSafe at safeinfo@agsafe.org or 209.526.4400. These provide an excellent place for growers to start the critical and important task of further protecting their business by more thoughtfully considering who to engage when trying to tackle the ever-present labor challenges.

For more information about worker safety, human resources, labor relations, pesticide safety, or food safety issues, please visit agsafe.org, call 209.526.4400, or email safeinfo@agsafe.org. AgSafe is a 501c3 nonprofit providing training, education, outreach, and tools in the areas of safety, labor relations, food safety, and human resources for the food and farming industries. Since 1991, AgSafe has educated over 85,000 employers, supervisors, and workers about these critical issues.

Featured Image: Photo by Randy Caparoso

Have something interesting to say? Consider writing a guest blog article!

To subscribe to the Coffee Shop Blog, send an email to stephanie@lodiwine.com with the subject “blog subscribe.”

To join the Lodi Growers email list, send an email to stephanie@lodiwine.com with the subject “grower email subscribe.”

To receive Lodi Grower news and event promotions by mail, send your contact information to stephanie@lodiwine.com or call 209.367.4727.

For more information on the wines of Lodi, visit the Lodi Winegrape Commission’s consumer website, lodiwine.com.