At over $12 billion annually, the research and development (R&D) tax credit is one of the largest tax incentives available to businesses. For wineries and grape growers, the potential tax savings could be significant. Yet many Northern California wineries and growers are missing out. Some businesses are just unaware of the credit’s existence, and the others that are aware may not be taking full advantage of the credit. Companies that fail to realize the benefits of the R&D tax credit often do so because of a lack of understanding about what activities qualify as research, what expenditures qualify for the tax credit, and what documentation sufficiently supports their research.

Understanding Which Activities Qualify as Research & Development (R&D)

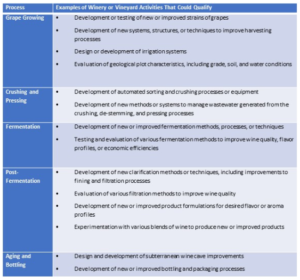

Activities that occur throughout each stage of the winemaking and grape growing process have the potential to qualify for the credit. Following is just a partial list of activities that could qualify:

Qualifying R&D activities are widespread amongst the wine making and grape growing industries, but many companies fail to claim the tax credits for which they are eligible.

Understanding the tax code definition of qualified research is the starting point for any company looking to claim the credit. Any company that encounters and resolves technological challenges may be eligible for the credit. That said, eligibility largely depends on whether the work you’re conducting meets the criteria established by the tax code’s four-part test:

- Elimination of uncertainty. You must demonstrate that you’ve attempted to eliminate uncertainty about the development or improvement of a product or process.

- Process of experimentation. You must demonstrate – through modeling, simulation, systematic trial and error, or other methods – that you’ve evaluated alternatives for achieving the desired result.

- Technological in nature. The process of experimentation must rely on the hard sciences, such as engineering, physics, chemistry, biology, and/or computer science.

- Qualified purpose. The purpose of the research must be to create a new or improved product or process, resulting in increased performance, function, reliability, or quality.

Documenting Activities and Expenses

Some of the eligible expenses for the R&D tax credit are wages (as reported on Form W-2, Box 1), supplies used in the research process, and contractor expenses that would be eligible if the same services were performed in-house.

After identifying qualified research, it’s critical to document the activities and demonstrate a connection between your qualified activities and your eligible expenses. The importance of this documentation cannot be overstated. Accurately tracking qualified activities and their related expenses can help your company realize the benefit of the R&D tax credit.

Your company may already be documenting its R&D efforts, in which case it may just be a matter of improving the records you keep or making adjustments to your documentation processes to ensure that you capture the records necessary to properly support the tax credit. Examples could include project notes, lab reports, e-mails, or other documents that help demonstrate how your activities meet the four-part test.

Using the R&D Tax Credit

Companies that are not currently taxable should still consider taking advantage of the R&D tax credit, since the federal credit can be carried back one year and forward 20 years (and many state R&D tax credit programs also have lengthy carry-forward provisions). Certain elections must be made on your tax returns, and it’s much easier to collect documentation and support for credits identified and claimed at the same time the expenses are being incurred rather than looking back and doing so historically.

Recently, the R&D credit was enhanced and made permanent. One enhancement allows eligible small businesses to use their credits to offset the alternative minimum tax, and another allows qualified small businesses to use up to $250,000 in credits against their payroll taxes. Both enhancements are a windfall for companies and their owners who haven’t been able to use their credits in the past.

The amount of R&D tax credit that wineries and growers can claim will depend on many factors, but the potential tax savings could make it well worth the time it takes to investigate. Companies that haven’t previously taken advantage of the credits can look back to all open tax years – typically three to four years depending on the taxing jurisdiction – to claim the missed opportunity.

This article was written specifically for the Lodi winegrape industry by Travis Riley, Senior Manager – R&D Tax Services and Christopher Crifasi, CPA, MST, a Tax Manager for Moss Adams – Agribusiness Industry. You can also learn more about R&D tax credits HERE.

Have something interesting to say? Consider writing a guest blog article!

To subscribe to the Coffee Shop Blog, send an email to stephanie@lodiwine.com with the subject “blog subscribe.”

To join the Lodi Growers email list, send an email to stephanie@lodiwine.com with the subject “grower email subscribe” or click on “join our email list” to the right.

To receive Lodi Grower news and event promotions by mail, send your contact information to stephanie@lodiwine.com or call 209.367.4727.

For more information on the wines of Lodi, visit the Lodi Winegrape Commission’s consumer website, lodiwine.com.